Cheap Life Insurance for Smokers

Cheap life insurance for smokers can be found when you choose the right company. Life insurance offers financial security for you and your loved ones.

Cheap life insurance for smokers can be found when you choose the right company. Life insurance offers financial security for you and your loved ones.

Here’s the bottom line lifted to the top for your convenience. Unless you truly can’t qualify for a simplified issue life insurance policy or a

As part of our ongoing review of life insurance companies, we are pleased to offer our company review of Royal Neighbors of America Life Insurance

Most adults understand that they need life insurance to cover financial risks when they die, especially if you have a family who relies on your

If you buy a 500k term life insurance policy and die, it may be enough to pay for the mortgage on your family’s home and

Buying a $250,000 term life insurance policy is pretty easy. There isn’t a lot of research needed to make your choice. Pretty much all life

A million-dollar life insurance policy could seem like a lot, but it can also be too much. When calculating your life insurance needs, for your

While Covid-19 and its variants continue to impact the health of Americans in almost every community, city, and state, it’s only natural that a considerable

Bestow was launched in 2016 as an alternative option to traditional life insurance policies, that requires extensive medical testing before being approved. Bestow offers an

Zander Insurance is one of the oldest independent life insurance agencies in America, dating all the way back to the 1920s. Independent life insurance agencies

Assurity Life is a major life insurance provider that many people turn to for coverage. They have over a century of experience and offer a

Foresters Life is a life insurance company that prides itself on providing policyholders with exclusive member benefits. They offer both term and permanent life coverage

The long-term care rider diverts part of your policy’s death benefit toward paying for your long-term care costs if you got sick or injured and

Understanding the Need for Life Insurance Life insurance is a cornerstone of financial planning, yet it often goes undiscussed due to its association with dying.

Insurance companies abound, and virtually all of them offer life insurance policies. Should you bundle with the company that covers your home or car to

Originally known as Country Mutual, Country Financial was created in 1925 to provided farmers with equipment and crop insurance. In fact, it did not add life

Are you an Amica Mutual client interested in seeing whether or not bundling life insurance with your home and auto coverage is worthwhile? Are you

Pacific Life Insurance happens to be one of the country’s oldest insurance companies. Founded in 1867 in California, it began offering life insurance policies in

National Western Life Insurance Company (NWL) is not a well-known insurer. They have a range of niche insurance products that provide unique choices. These offerings

As a member of the Fortune 500 list for the past 17 years, Auto-Owners is a trusted and successful insurance company. The company has a

Life insurance is an essential part of any financial plan, but with so many options, it can be difficult to find the right policy. Ethos

Life insurance provides financial security for you and your loved ones when you die. When purchasing a policy, it’s essential to choose a stable life

Fabric Life Insurance is a relatively new entrant to the market. Fabric Life Insurance was founded in 2015 by Adam Erlebacher and Steven Surgnier. Adam

Phoenix Life Insurance, now Nassau Life Insurance Company, traces its roots back to 1851. The company has always been an innovator. Over a century ago,

When the unthinkable happens, you want your loved ones to be protected financially. A life insurance policy will provide funds to cover missed earnings and

Life insurance is the best way to protect your family from financial hardship in the event of a disaster, and AIG is a name that

If you are considering a Lincoln Heritage Funeral Advantage final expense insurance policy, this review will provide detailed answers to all your questions. Before purchasing

As far as popular American life insurance providers go, some people might be surprised to find Costco life insurance among them. The following Costco life

Being one of the largest life insurance agencies in the United States, many people are familiar with SelectQuote. Considering the agency’s widespread recognition, this SelectQuote

A lot of shoppers prefer buying life insurance through agents or brokers because they can see a variety of quotes at one time, making it

A Life Insurance Retirement Plan, or LIRP, is a uniquely structured permanent life insurance policy that can do a great deal more than just deliver

Life insurance on your children is an interesting, and sometimes controversial, topic in insurance circles. In this post, we’ll strip away the confusion to consider

When you are looking for life insurance to make certain that surviving loved ones will not experience financial issues when you die, it makes perfect

Beginning in 1904, Mutual Trust Life Insurance Company has both grown and expanded significantly. With more than 110 years in the business, this company offers

While life insurance can seem complicated, it’s an essential part of protecting your family financially if a tragedy were to happen. Vantis Life seeks to

Can you guess one of the most popular reasons to buy life insurance? Among our clients, “becoming a parent” ranks right up near the top.

Aflac Life Insurance is one of the most popular insurance providers across the country today. Right now, more employees in the United States have voluntary

For many American consumers, The Hartford is one of a handful of insurance companies that most will feel comfortable with buying insurance products from. Most

The good news for individuals and families who are currently shopping for life insurance is that in today’s competitive market, you’ll never find a cheaper

Life insurance mitigates financial risks when the insured person dies. It’s actually a very straightforward concept. The life insurance policy (contract) is simply a promise

Brighthouse is a long-standing name in the insurance industry with a large customer base nationwide, but are they right for you? Let’s take an in-depth

Smokers worried about paying expensive life insurance premiums often ask about no-exam coverage. After all, they say, if I’m going to pay super high tobacco

Ladder is an online insurance company that offers life insurance via its online platform. They offer competitive rates for their products. And are great for

If you’re a little intimidated by the life insurance application process, and the time it takes to get approved, you’ll be interested in Haven Life

Purchasing life insurance may be one of those things you put off for another day, but in truth, it should be at the top of

Paying the premiums keeps your life insurance coverage active. If you died with coverage in place, your family could claim your policy’s death benefit. The

There was a time, not so many years ago, when getting life insurance with HIV/AIDS would’ve been impossible. I’m not going to lie – it

Antiquated terms like “estate planning” can make your financial life unnecessarily confusing. An “estate” sounds like something grand — a spread of land surrounded by

If you’re someone who believes you don’t need life insurance, you may want to reconsider. Buying a life insurance policy isn’t just for parents and

It’s never too early to start thinking about life insurance coverage. With an effective life insurance policy in place, you can rest easy knowing your

If you’re a responsible partner and parent, you’ll be looking to the future and considering life insurance if you don’t already have coverage in place.

Life insurance, often considered the bedrock of solid financial planning, can sometimes be a maze. The premiums – the amounts you pay for a policy

Life insurance candidates with diabetes already know finding affordable coverage can be difficult. Chronic health conditions like diabetes limit your coverage options. That’s just the

Heart disease has a way of giving you perspective. Goals that once seemed important fade to the background, and you focus on what really matters:

Considering life insurance? Purchasing life insurance is one of the best ways to protect the people you love, but it is often met with reserve

You’ve started to reach the stage of life where you’ve settled down. You may have a mortgage, maybe a family with some kids. Hopefully, you

Shopping for life insurance isn’t fun. It’s boring. It’s morbid. It’s a painful task. It’s still not fun, but it’s never been easier. There are

GEICO is one of the most popular insurance companies in the United States for auto and home insurance. So it’s not surprising that many GEICO

It’s easier than ever to find cheap life insurance, yet many people still think buying coverage would be too expensive, too big a hassle, or

As an independent broker, we are constantly growing our stable of insurance policy providers. Today we work with over 40 life insurance companies. While they

I know it can be uncomfortable thinking about your death, but if you’re looking to the future, you should include life insurance in those plans.

By age 65, it is likely that you have already purchased a life insurance policy, and it’s possible that you are looking to extend that

Today’s life insurance policies often come with many bells and whistles, offering policyholders some options that might even sound too good to be true. One

We get a lot of questions about Globe Life Insurance Company. Most people who ask have seen the “$1 for up to $100,000 worth of

There are almost 14 million people in the U.S. today who are either cancer patients or cancer survivors. The fact is that most cancers can

If you were diagnosed with melanoma, you might have started thinking about the future. A lot of people start making serious decisions after being diagnosed

Can I Get Life Insurance with Atrial Fibrillation? Understanding Your Options Living with Atrial Fibrillation (A-fib) can be challenging. Buying life insurance with a-fib could

Having a chronic condition does not simplify your search for life insurance. But with the plans available today, it is common to have several options

Chronic Obstructive Pulmonary Disease, otherwise known as COPD, is one of the most common lung diseases experienced today. Taking two main forms: Chronic bronchitis that

As a skydiver, you understand the importance of living life to the fullest. In fact, you make a point to live in a way that

Believe it or not, life insurance does tend to differ when it comes to scuba divers. This is due to that fact that extreme sports

Buying a life insurance policy can be a little confusing, and it’s even harder if your hobbies or career are considered “high risk” by the

Investments are important and making sure that your finances are in order should be at the top of the list. That’s why we believe life

Life insurance coverage should be considered as an integral part of any good solid financial plan – both personal and business. The proceeds from such

Many life insurance companies offer a terminal illness rider. Such a rider allows the insured to use a portion of their death benefit while they

In your 20s, the future looks exciting and adventurous, with few clouds and no discernible shadow of potential tragedy. Though you’re unlikely to look to

There can be any number of reasons to apply for life insurance. These can include having the assurance that loved ones will be able to

Life insurance is a complicated topic. There are tons of factors and terms that you’ll need to understand in order to have the best protection

There are a few factors that can make obtaining a life insurance policy difficult such as a serious health issue, risky lifestyle choices (i.e. driving

Those that are interested in $100,000 term life insurance have several options to choose from. There are generally 2 categories to consider, policies that require

It is always best to do your research and make sure that you choose an insurance carrier that provides the right type and amount of

If you co-own a business, one of your primary concerns must be business continuity if one partner dies or becomes permanently disabled. A buy sell

A variety of different factors are considered when underwriters are analyzing an applicant for approval for coverage. In addition to the standard health conditions that

Matrix Direct was a huge innovation when it launched back in 1995. It was one of the first attempts to harness the internet to connect

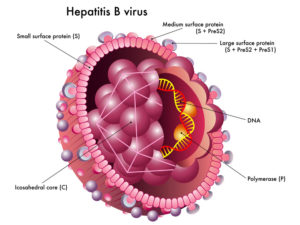

When you apply for a life insurance policy, one of the most important factors is your current health condition. For those who have Hepatitis B,

Many factors affect how long a consumer chooses to carry a term life policy. These might include their age, the price of the policy, and

Searching for the most suitable carrier, and American General came across your path? You might know for certain you need coverage. But you may still

Many people have life insurance policies in place by the time they reach middle age. Most have their first child by this point, get married,

In the past, breast cancer survivors weren’t able to qualify for life insurance at all. In part because of better treatment options and higher survival

If you’re 40 years old (or older) and are seriously considering purchasing a life insurance policy, then you’re probably also looking for the best rates.

Whether you are an accountant or any individual looking to protect your loved ones, finding quality life insurance can be challenging. While it’s difficult to

If you’re trying to get life insurance with high blood pressure (or hypertension), you should be aware of how insurance companies determine who gets approved

One factor that most people don’t realize is your DMV records. Getting charged with a DUI can affect your chances for life insurance. The key

Today the economy is unpredictable, and student debts continue to rise. Many parents and guardians find themselves grappling with an unexpected question: should they get

If you’re a young family or a working family, hopefully, you’re using a well-planned budget; and, if anyone depends on your income, hopefully, a piece

Life insurance is one of the most important parts of any financial plan. When purchasing life insurance, it is imperative to choose the right type

It probably wouldn’t make a good scene in a horror movie, but it would be horrific. Do you know what your spousal rights to life

You have many things to consider when applying for Medicaid. Eligibility requirements differ from state to state. Each state has stipulations about life insurance and

This article is going to look at some of the advantages of a 15-year term life insurance policy and when you should consider purchasing one

You might already be familiar with a 20 or 30 year term, but have you heard of 25 year term life insurance? The following article

Most people think that you get denied for life insurance because of a health condition. However, there may be other reasons why someone may get

Transamerica is one of the oldest providers of life insurance in the U.S. The company dates back to 1904 and has over 19 million customers.

Looking for a whole life product that will cover a wide range of aging policyholders? Sage Whole Life by Sagicor Life Insurance is a non-participating

Protective Life is one of the best life insurance companies we work with here at BestLifeQuote.com, and it definitely ranks among the top, thanks to

With thousands of life insurers out there, it can be overwhelming when you’re trying to decide which ones work best for you. Each company has

You probably know that life insurance companies aren’t a fan of cigarettes. You know about smoker’s rates and how expensive they can be, but how

Most adults around the age of 45 with a wife and three children understand the need for a solid life insurance policy. They understand that

People often ask me “which is the best life insurance company”. There are actually many excellent providers and the right company for you will depend

Life insurance policies often come in six figures or more in order to cover a variety of expenses, debts, and of course absence of income.

In putting together any financial plan, it is likely that most people should at least consider life insurance. One reason for is loved ones and

When you’re going through the process of creating a financial plan, there is a good chance that you may need to include life insurance. This

Planning for your financial future can include making investments that grow and compound over time. This process also includes ensuring that your loved ones are

So you have a risky job. Or perhaps you have a son or daughter who does. And you’re wondering how life insurance will fit into

Many factors go into choosing the right life insurance company. Because life insurance is a long-term investment, you’ll want to be sure that you’re selecting

If you’re like most people, you’ve heard of AAA Life Insurance Company is among the best life insurance companies in the U.S. this year. AAA

When applying for life insurance, people are often concerned about the health exams or blood tests that might be required. Medical exams are common when

About Banner Life Insurance Banner Life Insurance Company – along with William Penn Life Insurance Company of New York – underwrites and issues life insurance

Farmers Life Insurance is a brand many people know, thanks to its catchy “We Are Farmers” advertisements, but is Farmers the right choice for life

Update: As of Sept 1, 2014, ING Reliastar Life Insurance is now known as Voya Financial. There are thousands of different insurance companies, which can

Allstate has been in business for many years and they are a financially sound company. In fact, A.M Best, which is the insurance industry’s main

Life insurance is typically reserved for working parents, but it can also be useful to have for stay-at-home mothers as well. No one wants to

Many people buy life insurance in their 30’s because this is the time many of us begin to settle down and raise families. Many hesitate

One of the most confusing parts of life insurance is deciding the best type of coverage. Every family has different life insurance needs. Because of

Finding the right policy for life insurance with asthma can be complex depending on the severity. If you are an asthma sufferer who is currently

Shopping for life insurance can be troublesome, and it’s even harder if you have a health problem, like prostate cancer. Your medical history and any

Trying to get quality insurance products at an affordable price can be a tricky process. When applying for a small business loan through a bank

If you have a pre-existing condition, you’re going to encounter some unique complications when you’re trying to get affordable life insurance. Multiple sclerosis can be

Type 2 diabetes is a common health condition that affects millions of Americans. If you have this condition, you understand first-hand that it can be

Life insurance can be a tricky topic. Every person is different and is in different situations. It’s almost impossible to make any statements or decisions

If you’ve never shopped for life insurance before, you may not know how many kinds of plans there are. You may assume they are all

If you have been rejected for life insurance in the past because of Hep C, you don’t have to go without coverage. There are still

Life insurance comes with many different options, and you may have heard about second to die life insurance. We’ll cover how this type of life

Primerica offers life insurance along with many other companies in the marketplace. If you are in the market for life insurance, you want to make

We all know we will eventually pass away, but thinking or planning for it can be very uncomfortable. Still, buying a life insurance policy provides

The proceeds from life insurance – which are received by the beneficiary free of income tax – can be used for a wide variety of

Some people believe that they are uninsurable— or at least, only insurable at very high rates— if they are shopping for life insurance with high

We’ve all heard a lot of talk these days about pre-existing medical conditions for health coverage, and at first glance, life insurance policies are no

Many Americans, both young and old, suffer from diabetes. Aside from the physical limitations they face every day, it can prove difficult to get approved

There is an almost endless number of different life insurance plans that you can choose from. You have many options to give your family the

All it takes is one stroke to realize the importance of life insurance. Unfortunately, many stroke survivors are under the impression that their medical history

There are two main parts to any life insurance policy. The person who bought the plan, and the person who’s going to receive the payout

I know a million dollar life insurance policy sounds like a lot of money. But many people with families should have a million dollar policy

If you’re packing on a few extra pounds or even more than just a few, you’re in good company. In this blog post, I’ll cover

Yes, shopping for life insurance coverage in your 50s works differently than it did in your 30s. Rates for the same coverage will cost more

Life insurance is as important for the 18 million Americans with sleep apnea as it is for people without the disorder. Because it’s such a

As an entrepreneur, your business has a critical role in the economy’s growth. Your creative thinking and innovation is evident in the products, services, and

If arthritis has become part of your everyday life, you are not alone. According to the Centers for Disease Control, osteoarthritis affects about 27 million

Investing in life insurance is one of the best financial decisions you can ever make. Life insurance provides for and protects your family from a

State Farm is one of the most recognizable insurance providers in the insurance industry. State Farm offers insurance coverage like auto insurance, home insurance as

If you are researching life insurance companies and live in New York, you may be considering William Penn Life Insurance Company of New York. With

Getting life insurance can be worrisome if you have been diagnosed with lupus. Since there are higher risks associated with this disease, many companies may

When a loved one passes away without life insurance coverage, the expenses only add to the stress and emotion of what’s going on. It’s crucial

We know finding the right life insurance policy can be difficult. There are thousands of companies to choose from, and you and your family have

You may have never heard of North American Life Insurance Company. But they are well-known for their Universal Life policies. And they now have a

If you have heard about Mutual of Omaha and want to find out if they are the best life insurance company for you, we are

If you are considering SBLI for term life, this article will cover their history, financial strength ratings, and how they rank in terms of pricing.

MassMutual is one of the largest, most highly-rated life insurance companies in America. Founded in 1851, this Springfield, Massachusetts company is an established life insurance

When you purchase a life insurance policy, you want to be 100% certain that the provider will pay your beneficiaries when/if the time comes. With

Update: As of August 7, 2017, MetLife is now known as Brighthouse Financial, Inc. MetLife is one of 30 insurance companies that we represent. Therefore,

With so many different insurance companies to choose from, the process of getting affordable coverage can become, well, overwhelming. It’s vital that you find a

There are two main options available when it comes to life insurance. Permanent Life (in the form of Whole or Universal) or Term Life Insurance.

*2018 Update – Genworth no longer sells life insurance policies including no medical exams and traditionally underwritten policies.* Not only are there different types of

Some people believe you can’t get good life insurance policies when you’re ‘past your prime’, meaning, if you are thinking about purchasing life insurance at

One of the biggest questions that people often have about life insurance is how it relates to other kinds of financial vehicles and financial planning.

Many people think that they cannot get affordable coverage past their 60s, but there are actually many options available. Those who are at or nearing

We get a lot of questions about how marijuana is going to affect life insurance plans and how much users will pay for life insurance,

You buy life insurance to protect the people you care about, but what about the causes you care about? This is where added a charity

There’s a great line in the classic 1946 movie, It’s a Wonderful Life, in which an exasperated elderly man says, “Oh, youth is wasted on

We often get through life by making educated guesses. You’re fixing dinner, using a recipe you’ve never used and suddenly realize you don’t have the

When applying for life insurance, it is important for the insurer to learn as much as possible prior to taking on a client. This is

It doesn’t matter where you have a dollar or a million of them, a credit card or a check, a piggy bank of a pension.

Veterans returning from Afghanistan and other dangerous countries must sometimes feel like the home front isn’t all that better than the war zone. After all,

Everything you know about telling a lie is true. It isn’t a good idea. No news flash, of course — lying about anything can get

It’s the type of problem we all want. What if you come to realize that you need a really big life insurance policy? …because you’re

It’s a long-held belief that life insurance doesn’t pay out if the policy holder kills themselves. But that’s a misunderstood belief and partially a myth.

It’s entertaining to read about in a murder mystery or to watch on a fictional television show, but heartbreaking in real life. Sometimes when people

When you’re applying for any kind of life insurance, you must go through the underwriting process. We’ve been in the insurance industry for years, and

If you enjoy watching an entertaining, old-fashioned western on TV, then you would probably accept the notion of a gunslinger jumping out of a window

Applying for life insurance when you have various health conditions can be challenging. Depending on the specific diagnosis that you have, it is possible that

In addition to just paying out a benefit upon one’s death, life insurance can be used as part of an overall strategy for retirement, estate,

Life insurance is a type of thing nobody wants to pay for but is always glad they did when the need arises. In addition, it’s

As we go down the road of life, there will be many changes. Some are happy, and some are not. If your marriage does not

Life insurance can be purchased for any number of different reasons. Often, because life takes us through so many changes, the needs that life insurance

Life insurance should be considered a part of any financial plan. The proceeds from a life insurance policy can provide numerous benefits. The most obvious

Life insurance is unique in that— unlike other forms of insurance— the policyholder is not the person who is protected. Instead, it is the beneficiary

Today I want to talk to you about some common term life insurance questions and answers. So let’s talk a little bit about some common

Bankruptcy is a legal process which allows an individual or business to deal with mounting debt. There are many types of bankruptcy, some of which

Group life insurance is often provided as part of a complete employee benefits package. In fact, the affordability of coverage is one of the primary

We talk to a lot of applicants who have no idea how long of a plan they should buy. It’s an easier decision than you

You have life insurance, but that might not be enough. What happens when you need to protect yourself from the tax man? Creditors? Prying eyes?

Understanding Flat Extra Premiums in Life Insurance: A Comprehensive Guide When it comes to protecting your family’s financial future, life insurance stands as a shield.

There are, of course, a myriad of reasons that lead U.S. citizens to live abroad for either a temporary or long-term period. Work can take

Dave Ramsey has become a star in personal financial planning circles. One of the things he constantly comments on is life insurance. But should you

Having life insurance in retirement can be comforting and seem worthwhile if you don’t have a big enough nest egg to leave your family when

Fatal accidents occur so often that insurance companies now offer accidental death benefit life insurance riders and policies. What are accidental death benefit riders? What

It’s a pretty morbid thought – someone is going to financially benefit from your death. But should it really creep you out? Life Insurance Beneficiaries

People don’t usually think about high risk occupations being a concern with insurance. It’s obvious that pre-existing health conditions, such as smoking or being overweight,

Everyone who applies for life insurance is assessed for coverage. Insurers provide coverage and premium rates in accordance with an applicant’s risk level. To that

There are options for life insurance for active-duty military members with a variety of different components. Servicemembers Group Life Insurance (SGLI), Veterans’ Group Life Insurance

If you have angina pectoris or another form of cardiovascular disease, then you will need to know what to expect in terms of term life

After you have begun the (long) process of buying a life insurance policy, you will have to answer some questions on the application related to

Adverse health conditions are generally thought to be the reason why one would be turned down for life insurance coverage, but health conditions are only

Most people who enjoy cigars assume that, when it comes to term life insurance, they will automatically be given the much more expensive “Smokers’ Rates”

The whole point of term life insurance policies is that they provide you with coverage when you need it the most— when you are still

When standard life insurance packages aren’t offering the coverage you need, you can purchase additional security with something called a “rider.” These are insurance add-ons