Can I Get Life Insurance with Atrial Fibrillation? Understanding Your Options

Living with Atrial Fibrillation (A-fib) can be challenging. Buying life insurance with a-fib could also be challenging. Having A-fib does not disqualify you from obtaining life insurance. Here’s a comprehensive guide on the path to securing life insurance with A-fib.

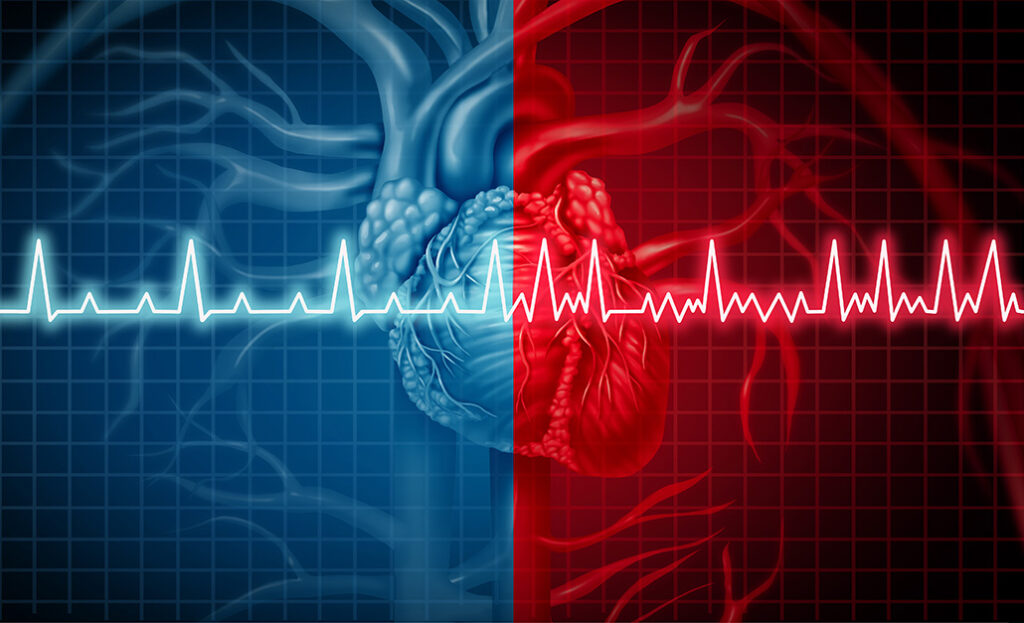

Understanding Atrial Fibrillation (A-fib)

A-fib is characterized by an irregular, rapid heart rate, which can potentially lead to complications like stroke. It occurs when the heart’s upper chambers (the atria) beat out of sync with the lower chambers, causing poor blood flow.

The Life Insurance Application Process for A-fib Patients

While A-fib is a significant health consideration, it doesn’t automatically rule out life insurance. However, insurers will pay close attention to your condition:

- Health Assessments: Insurance companies will examine your medical history, potentially requesting an Attending Physician Statement (APS). They’ll also likely require a medical exam – from checking vitals like blood pressure and heart rate to possibly requesting an EKG.

- Rate Determination: Your rates are affected by how controlled your A-fib is. A well-managed condition can lead to better health ratings and more favorable premiums.

A-fib in Action: Real-life Case Studies

Imagine John, a 45-year-old diagnosed with A-fib five years ago. After getting his condition under control with medication, he approached a life insurance company. With his recent EKG showing normal results and a positive report from his physician, John was able to secure a standard rate for his life insurance.

On the other hand, Sarah, diagnosed at 60, faced higher rates due to her age and a history of intermittent heart rhythm issues. Luckily, we were able to shop around with various carriers to find out which will be able to insure her.

How A-fib Influences Your Rates

Having A-fib can lead to an increase in premiums compared to someone without the condition. But several factors come into play:

- Age at Diagnosis: Earlier diagnosis might indicate a longer history with the condition but might also mean the potential for better management over the years.

- Treatment History: Successful treatments can be favorable, especially ones that have maintained a normal heart rhythm for extended periods.

- Overall Health: Other health conditions, lifestyle factors like smoking, and family history can also impact rates.

Exploring Types of Life Insurance for A-fib Patients

- Guaranteed issue life insurance: These policies don’t require medical exams or health questions, making them an attractive option. However, they often come with higher premiums and lower face amounts.

- Standard Life Insurance: If your A-fib is under control, there’s potential to qualify for regular life insurance rates, especially with conditions like Paroxysmal A-fib, which tends to self-resolve in less than 24 hours.

The Value of Independent Agents

Navigating life insurance with A-fib can be daunting. This is where independent agents come into play. With experience in high-risk applications, we can guide you to companies that offer competitive rates for your unique needs. Think of us as your personalized insurance matchmaker!

What Others Are Saying:

“I thought my A-fib would make life insurance impossible. But with guidance from my independent agent, I found a policy that fits my needs.” – Michael, 52

“As someone with A-fib, the insurance landscape was confusing. My agent clarified the process, helping me secure a policy that gives me peace of mind.” – Linda, 49

Frequently Asked Questions

- Can I avoid a medical exam when applying for life insurance with A-fib?

While there are guaranteed life insurance options that don’t require exams, they often come at higher costs. Evaluating what’s more important is essential: avoiding an exam or potentially lower premiums.

- How long should I wait to apply for life insurance after an A-fib diagnosis?

It varies. Some insurers prefer seeing a history of successful treatment, while others might offer coverage soon after diagnosis, depending on other health factors.

In Conclusion

Atrial Fibrillation, while a significant health condition, doesn’t close the door to life insurance. The key is understanding the landscape, possibly with the aid of an independent agent. Whether you’re newly diagnosed or have lived with A-fib for years, there’s likely a life insurance policy out there for you. Don’t let A-fib deter your pursuit of financial security and peace of mind.