Here’s the bottom line lifted to the top for your convenience. Unless you truly can’t qualify for a simplified issue life insurance policy or a final expense policy, you’ll pay too much for Colonial Penn life insurance. We will help you understand what the Colonial Penn 995 plan and how much coverage you will get with it. Let us show why by comparing the benefits and the rates against other final expense life insurance options. We even have some stats on Colonial Penn negative reviews to share.

Colonial Penn Life Insurance Review

Most people who watch any television have likely been exposed to advertising by the Colonial Penn Life Insurance Company. As an independent insurance agency representing many life insurance companies, we think life insurance advertising on television is a good thing. We’re delighted that the American public is routinely exposed to the need for life insurance. Our only concern is that misunderstanding a life insurance offering is easy to do, especially in the short space of time of a TV ad.

Life insurance is very important, and we believe buyers should understand the pros and cons associated with any offer so they can make an informed purchase decision.

This article is written to educate you about Colonial Penn life insurance products. We do not represent Colonial Penn and have no affiliation with this insurance company.

About Colonial Penn Life Insurance Company

Colonial Penn was founded and established back in 1968 by Leonard Davis. They are owned by CNO Financial Group, and their headquarters is in Philadelphia, PA.

Colonial Penn offers their life insurance products using direct mail, internet advertising, and television commercials. They claim that by selling directly to the consumer, they can offer life insurance cheaper than companies who depend on commissioned agents to sell their products.

Their only product is guaranteed acceptance of life insurance that they market to people aged 50 to 85. This is the product shown in their TV ads, which is quoted and sold by the unit rather than a particular face dollar amount.

Colonial Penn’s insurance rating is currently A-(Excellent) by A.M. Best (the world’s largest insurance agency credit rating company). This means Colonial Penn is financially stable and will not have difficulty paying claims or their business operating expenses.

Many insurance shoppers — especially older adults — consider Colonial Penn a good option for final expense insurance.

It may be the best insurance option for some shoppers; however, most people can find better coverage at lower monthly premiums.

Should you choose Colonial Penn, or can another company provide more coverage for less?

Colonial Penn Guaranteed Acceptance Life Insurance

Colonial Penn spends millions of dollars each year on marketing campaigns aimed at senior citizens who don’t have life insurance and who may not easily qualify for full coverage. With Colonial Penn, anyone within the right age range can purchase Colonial Penn Life Insurance (50-85). But this guarantee comes at a cost: higher premiums and small face amounts.

These policies don’t require a medical exam, making buying them convenient. However, many other leading insurers also have no-exam final expense options that cost less and give greater coverage. The maximum coverage will be around $25,000 for a 50-year-old, and the rate will be almost $150.00 per month.

Like most guaranteed issue policies, Colonial Penn requires a two-year waiting period before your full coverage level is available to your beneficiary. If you died within the two-year limited benefit period, your death benefit amount would be a fraction of its value unless your death was considered an accidental death.

Pros

- Easy to qualify for – Guaranteed Acceptance

- Fixed guaranteed premiums

- Can add additional accidental death benefit rider

- Easy application process

Cons

- Lower coverage amounts

- Higher cost per unit

- Confusing rate structure

- Age restrictions

Colonial Penn famously sells this product by the unit for $9.95 per month. What consumers are not told in the television commercials is how much life insurance coverage is provided in a unit of coverage.

And, to make things even more confusing, a unit of final expense life insurance coverage is based on the applicant’s age. A “unit” of coverage under the guaranteed acceptance plan starts at $1,669 coverage amount at age 50. The same unit for an 85-year-old decreases to $418 of coverage. So then, a 50-year-old wanting ten units of coverage would have a total death benefit of $16,690 and pay $99.50 per month for the policy. The 85-year-old wanting ten units of coverage would have $4,180 with the same cost of $99.50.

Colonial Penn Life Insurance Rates

Colonial Penn Life Insurance has a unique way of selling policies.

Life insurance rates are based on “units of coverage” instead of selling policies by face amount.

Here is the Colonial Penn life insurance rate chart compared with our two most affordable carriers. The rates listed are for a $10,000 guaranteed issue life insurance policy for a male non-smoker:

| Applicant Age | Colonial Penn | Gerber Life | AIG | Great Western |

|---|---|---|---|---|

| 50 | $59.70 | $44.09 | $55.99 | $59.56 |

| 60 | $89.55 | $63.89 | $68.14 | $75.39 |

| 70 | $149.25 | $99.18 | $106.00 | $119.54 |

| 80 | Not available | $247.32 | $206.32 | $227.83 |

We used a $10,000 policy for our comparison because the average funeral cost in America is between $8,000 and $12,000. Unfortunately, for some consumers who need life insurance to cover funeral expenses, Colonial Penn does not offer $10,000 in coverage. If you are 71 or older, you can’t buy $10,000 from Colonial Penn. You can find it from Gerber Life, AIG, and Great Western.

As you can see from the chart shown above, Gerber Life, AIG, and Great Western are priced lower than Colonial Penn. These rates indicate that eliminating the agent advocate from the transaction does not save you any money.

Other red flags we discovered are the way Colonial Penn sells by the unit, which is unlike any other insurance company and, as explained above, very confusing. They also make a big deal out of their 30-day money-back guarantee. Colonial Penn calls this the Try-it-on Period. That sounds great, but all life insurance policies offer this and call it the free look period.

If you live in New York, your policy will be underwritten by Bankers Conseco Life Insurance Company.

Colonial Penn $9.95 Plan

Colonial Penn only sells guaranteed issue policies, which it sells by units of coverage instead of by dollar amount.

Selling insurance by “units” lets the company charge a simple price — $9.95 for a unit per month.

The problem with this approach is that the shopper may not know what a unit is worth. What do you get with the Colonial Penn $9.95 Plan?

How Much Insurance Coverage Do You Get for $9.95 with Colonial Penn?

The value of a unit of coverage changes as you age. For example, the Colonial Penn $9.95 unit provides $1,669 in coverage for a 50-year-old. The same $9.95 unit provides only $418 in coverage for an 85-year-old.

As an 85-year-old, if you buy the maximum, you could buy up to 15 units, which would cost $149.25 per month, and you would get only $6,270 in life insurance coverage.

For reference, a 50-year-old in good health could buy a 20-year term policy for $500,000 from Banner Life Insurance, which would cost 83.15 per month.

Unless you are uninsurable, you will save money by purchasing a fully underwritten life insurance policy.

Is Colonial Penn Life Insurance $9.95 Plan A Good Deal?

The short answer, as you can probably tell, is no. While you will not be denied coverage from Colonial Penn, you will pay more for your policy. You have other options for guaranteed issue final expense life insurance policies.

Colonial Penn’s guaranteed acceptance drives up the prices you’ll pay. If you’re healthy, or if you are not healthy, look elsewhere for lower premiums and more coverage. You can get a quick price quote by using the calculator on the side of this page.

Colonial Penn Negative Reviews

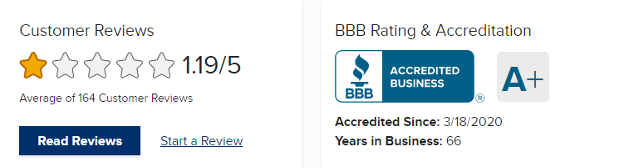

The Better Business Bureau (BBB) currently gives Colonial Penn an A+ because the company responds to every complaint. However, Colonial Penn does receive a fair amount of negative customer reviews.

Still, the company has been sued countless times for various reasons.

As mentioned, the company offers a 30-day money-back guarantee if you change your mind about the coverage. That is standard with all life insurance plans.

However, many customers don’t become upset with their life insurance plan until a few years go by — long after the 30-day full refund period has expired. That is when many will post negative reviews about Colonial Penn.

Is Colonial Penn Life Insurance a Scam?

Despite our view of Colonial Penn’s marketing tactics, the company is not fraudulent. It’s not part of a scam. The company has a reputable past and is financially stable with an A.M. Best rating of A (Excellent). We do feel that the Colonial Penn $9,95 plan is misleading to seniors who may not know there are other options for final expense life insurance.

Alternatives to Colonial Penn $9.95 Life Insurance Plan

Yes, having a Colonial Penn plan is better than having no life insurance, but it’s still not the best choice. We did show you a rate comparison to the $9.95 plan earlier in this article. And we mentioned who we recommend instead of Colonial Penn. We can help you start your new policy with any of these companies. We can also review your Colonial Penn policy and compare rates to get you an exact quote.

Here are three quality companies that offer guaranteed issue life insurance at lower rates:

- Gerber Life

- AIG

- Great Western

Is Colonial Penn Life Insurance Best For You?

Colonial Penn only sells guaranteed acceptance life insurance policies that do not require a medical exam and do not ask health questions.

If you do need guaranteed issue coverage, a Colonial Penn life insurance policy may be a quick and easy way.

But if you do not have a serious health condition, you can get coverage for less money — normally a lot less money.

Why Colonial Penn Guaranteed Acceptance Insurance is Not Ideal

Insurance companies take a lot more risk with guaranteed acceptance.

Higher Risk = Higher Rates

Since it requires no medical exam and asks no questions about your health, Colonial Penn doesn’t know whether you’re at risk of dying next week or in 20 years. To stay in business, it has to assume everyone’s high risk and charge accordingly.

If you’re familiar with life insurance, you know your premiums are impacted by coverage amount and your health.

How Much Final Expense Life Insurance Do You Need?

A Colonial Penn Guaranteed Acceptance policy will pay out only a fraction of the death benefit you could get with a medically underwritten term or even many whole life insurance policies.

So, one of the first questions to answer is how much coverage you need. People typically buy a final expense life insurance plan to provide for burial expenses after they die. The death benefit from a final expense policy will likely not be enough to pay off credit cards, pay off a mortgage or auto loan, or prepare for future needs. If you need that coverage, you probably need to look at other options, such as term life or universal life insurance.

In that case, a Colonial Penn policy probably won’t be large enough.

If you’re buying life insurance for final expenses, you may need only $10,000 to $15,000 in coverage. A Colonial Penn policy could do the job, but as I said above, you could find better coverage for less if you’re in average health or better.

Should You Buy Colonial Penn Life Insurance?

As I said above, Colonial Penn may be fine for someone in poor health who can’t qualify for a better policy with another company.

The life insurance industry has many better options for people of average, good, or excellent health who don’t smoke. Even shoppers with health problems can often find better coverage from other life insurance companies.

Famous spokespeople such as Alex Trebek, Ed McMahon, Joe Theismann, and now Jonathan Lawson help assure TV audiences Colonial Penn offers them the coverage they need. It is great marketing. These ads don’t lie. Anyone aged 50-85 can qualify for this kind of life insurance. However, they fail to mention Colonial Penn’s high costs and low coverage amounts.

They also don’t inform viewers that an independent life insurance agent could find them more coverage for less money — and with no waiting periods or medical exams. There’s a reason insurance agents call guaranteed issue the last resort for life insurance coverage.

You can use our final expense calculator on this page to get your quote, which should come in lower than the Colonial Penn life insurance quote you currently have.

FAQs about Colonial Penn Life Insurance

What is Colonial Penn Guaranteed Acceptance Life Insurance and who is it for?

Guaranteed Acceptance Life Insurance from Colonial Penn is a type of whole life insurance policy specifically designed for individuals aged 50 to 85. It requires no medical exam or health questions, making it an ideal option for those with pre-existing health conditions or difficulty obtaining traditional life insurance. This policy offers a fixed premium that will not increase.

How does Colonial Penn’s $9.95 unit-based pricing work?

Colonial Penn’s life insurance policies are unique because they are sold in units. Each unit represents a specific amount of coverage, and the amount of coverage per unit varies based on the policyholder’s age. We find this rather confusing since every age is different.

Can I increase my coverage amount with Colonial Penn after purchasing a policy?

The ability to increase coverage depends on the type of policy you hold with Colonial Penn. For some policies, particularly guaranteed acceptance life insurance, the coverage amount is fixed and cannot be increased after purchase. However, policyholders may be able to purchase additional policies if they need more coverage, subject to the company’s rules and restrictions.

Does Colonial Penn offer life insurance policies for young adults or families?

Colonial Penn only focuses on life insurance products for individuals aged 50 to 85. Younger individuals or those with lofty coverage needs might find more suitable options with other insurers.